There are many factors to consider when choosing a forex trading app. Most forex brokers offer their trading apps for Android & iOS, but that does not mean it is safe.

A bad app will get in the way of you opening, and closing trades effectively, causing issues with withdrawals and can lead you to forex fraud.

We compared Forex trading apps and found the six best Forex trading apps in Nigeria.

Because there are many apps, it is easy to get confused in making a selection. We picked the best Forex apps in Nigeria by studying several apps, their safety, fees, withdrawals, ratings and community reviews.

Comparison of Best Forex Trading Apps in Nigeria

| Forex Trading App | Typical EUR/USD Spread | Minimum Deposit | Max. Leverage | |

|---|---|---|---|---|

| HF Markets MetaTrader App |

1.4 pips with Premium Account

|

₦4,000

|

1:2,000

|

Visit Broker |

| Exness MT4 |

1 pip with Standard Account

|

$10

|

1:2,000

|

Visit Broker |

| Octa |

0.9 pips with MT4 Account

|

₦15,000

|

1:500

|

Visit Broker |

| XM Trading |

1.6 pips with Micro Account

|

$5

|

1:1,000

|

Visit Broker |

| AvaTradeGo App |

0.9 pips

|

$100

|

1:400

|

Visit Broker |

| FXTM MetaTrader |

1.9 pips with Micro Account

|

₦10,000

|

1:2,000

|

Visit Broker |

List of Best Forex Trading apps in Nigeria

- HF Markets MetaTrader App – Best Forex Trading App in Nigeria

- Exness– Good Forex Trading App for MetaTrader

- OctaFX – Good Copy Trading App in Nigeria

- XM – MetaTrader Broker App

- AvaTradeGo App – Good Forex Trading App for Fixed Spread

- FXTM Trader App – Well Regulated Forex Trading App

Here is the detailed breakdown of each forex trading app in our list.

#1 HF Markets MetaTrader App – Best Forex Trading app

HF Markets is a CFD broker that offers its App to trade 53 Currency pairs, CFDs on 945 DMA Stocks, 54 Shares, 5 Commodities futures, 6 Metals, 4 Energies, 34 ETFs, 3 bonds, and 23 Indices.

Safety – HF Markets’ Trading app is considered low risk because HF Markets is licensed by 3 Tier-1 & Tier-2 regulators; the FCA, FSCA & CySEC. Also by Dubai Financial Services Authority (DFSA) and Financial Services Authority (FSA) in Seychelles. Traders from Nigeria are registered under ‘HF Markets (SV) Ltd’.

Fees – Their CFD trading fees are considered low as per our comparison. Their average spread for majors like EURUSD is 1.4 pips with their Premium Accounts, and there is no extra commission per lot with these Accounts. HF Markets Zero Account has spreads starting from 0.0 pips but also charges commissions on forex trades starting from ₦1,100 or $3 per side. HF Markets does not charge deposit or withdrawal fees. HF Markets does not charge deposit and withdrawal fees, but charge inactive account fees of $5 per month after 6 months of your account being dormant.

Accounts – HF Markets offers 5 types of trading accounts, with varying spreads, including an Islamic account, so you can choose the one that best suits your trading needs. They even have a Zero spreads account.

HF Markets has negative balance protection that prevents you from losing more money than you have in your trading account.

Trading Application – In addition to the HFM App which is owned by HF Markets and available on mobile devices only (iOS & Android), HF Markets supports MT4 and MT5 web-based and desktop platforms as well as the mobile app versions (Android & iOS).

The mobile app has most of the tools you need to manage your trades on available CFD instruments from anywhere. While you can deposit and withdraw directly from this app, it does not fully cover the functionality of the HF Markets website.

Deposits & Withdrawals – Traders can deposit a minimum of ₦4,000, and a maximum of ₦40 million at a time, through bank transfers and have it credited instantly. If you transfer in dollars, the maximum amount is unlimited, while the minimum deposit is $50 and you pay some processing fees. No fees are charged for deposits over $100. Dollar deposits take about 2 to 7 days to be credited.

You can deposit a maximum of $10,000 per transaction with debit cards like Visa and Mastercard and a minimum of $5. It takes about 10 minutes to reflect in your account.

HF Markets supports direct withdrawal to your Nigerian bank account and funds are received within 24 hours. This requires a minimum withdrawal amount of $10 equivalent in naira. It takes 2 to 10 business days to receive funds if you want the money transferred to a dollar bank account, and some charges might apply by the correspondent and receiving bank.

Withdrawals can also be made to cards, the minimum withdrawal amount is $5. With withdrawals in bitcoin through Bitpay, a fee of 1% of the transaction amount applies.

Support – HF Markets offers customer support 24/5 via email and live chat on the website or mobile app. They also have local phone support in Nigeria. Their support is good as per our tests.

#2 Exness – Good Forex Trading App for MetaTrader

Exness is one of the low-cost beginner-friendly CFD brokers that accept traders based in Nigeria. Financial instruments offered by Exness are 99 forex pairs and CFDs on 3 energies, 10 metals, 10 indices, 98 stocks and 35 cryptocurrencies.

Safety – Exness was founded in 2008 and they are registered in Seychelles as Nymstar Limited. Traders from Nigeria are registered under this regulation.

They are also Licensed by the FSCA, FCA & CySEC. This makes them a low-risk and safe CFD broker for traders in Nigeria.

Fees – The spread for the majority of CFD instruments is tight, with an average for majors like AUDUSD being 1.4 pips with Standard Account. Exness offers free deposits and withdrawals, with no commission on trades with Standard Account. They have low spread + commissions starting at $0.2 per side lot and up to $3.5 per side with Raw Spread and Zero Accounts. Exness offers free deposits and withdrawals and no account inactivity fees either.

Account – Exness offers 5 types of trading accounts with different features. They also have Raw Spread and Zero Spread Accounts with spreads starting from 0.0 pips. You can also apply for an Islamic Swap-free account on Exness.

Exness has negative balance protection that prevents you from losing more money than you have deposited into your account.

Trading Application – Exness is a MetaTrader-based CFD trading platform with MetaTrader 4 and 5, which provides standard and professional account types. The web trading platform is available, while the app is available for download from the App Store and Google Play Store.

You can run your custom scripts for automated trading on their MetaTrader platform. For a secure connection, Exness encrypts all communication between the server and trading platform with 128-bit keys.

The app has a Margin Calculator that easily determines your margin size, swap rates and pip values before placing a trade. It also has a converter to help you calculate the currency’s exchange rate. A Calculator is also available on their website.

Exness has MT4 MultiTerminal which allows you to manage multiple accounts, place new orders and allocate lots across various accounts simultaneously and monitor real-time positions.

Exness also has a proprietary trading mobile application ‘Exness Trader App’ which is available on iOS and Android devices.

Deposits & Withdrawals – Traders can instantly fund their accounts with online bank transfers in Nigeria at zero fees. The minimum deposit amount is $10 with a maximum of $45,000, while $3 is the minimum withdrawal amount and a maximum of $12,000 per transaction. Online bank transfer deposits in Nigeria are credited within 5 hours while withdrawals can take 24 hours. Deposits via cards are credited within 5 business days and withdrawals can take up to 10 business days.

Support – Exness has 24/7 customer support via email and live chat, as well as a knowledge base FAQs section with information on how to navigate and use the website and app.

#3 Octa – Good CopyTrading app

Octa is a forex broker that offers trading services on 35 currency pairs, CFDs on 10 indices, 30 cryptos, 150 stocks, 2 metals, and 3 energies through the MT4 and MT5 platforms, with the web-based platform and mobile app for Android and iOS.

Safety – Octa is considered a moderate-risk platform because it is licensed by only 2 Tier-2 regulators i.e. CySEC in Cyprus and FSCA in South Africa, with no Tier-1 license. Octa is incorporated in St. Vincent and the Grenadines, and traders from Nigeria are registered under this regulation.

Octa claims to have a segregated accounts system to keep the funds of customers separate from the company’s balance sheets. The personal data and financial transactions of customers are protected on the web and mobile platforms through 128-bit encryption.

Fees – Octa fees are moderate with spreads starting from 0.6 pips for most instruments with 1:500 Leverage for currencies. Deposits and withdrawals are free of charge, there are no commission fees on trades and no swap fees are charged. OctaFdoes not charge dormant account fees.

Account – Octa offers 2 account types on different platforms, The MT4 and MT5 Accounts. Octa has negative balance protection which means that you cannot lose more funds than your deposit.

Trading Application – Octa supports the MetaTrader applications for trading. You can access the Octa platform via the MT4 and MT5 trading platforms on the web and mobile devices (iOS and Android). Octa also has a proprietary trading application, Octa Trader, available on web and mobile devices (Android and iOS), called the ‘The Octa Trading App’.

The Octa application is fast and has a friendly UI/UX. Octa offers both Copy Trading and Auto Trading features to its clients. You may use them for trading in any market conditions and with any listed currency pair. Octa has online tools for analysis like market insights, economic calendar, converter and calculator.

Deposits & Withdrawals – The platform supports transfers from Nigerian banks with a minimum deposit of ₦15,000 which is credited to the trading account within 1-3 hours while cards (MasterCard) has a minimum deposit of €50 and is credited instantly. Deposits can also be made in cryptocurrencies like bitcoin, dogecoin, and others, which are credited within 30 minutes.

Traders can withdraw to Nigerian bank accounts, with a minimum withdrawal amount of ₦3,000. Withdrawals to cards are not supported currently. The minimum amount is $5 if you are withdrawing to Skrill and cryptocurrencies wallets. All withdrawal requests are processed within 3 hours and may take another 1 hour to transfer the funds.

Support – The platform has educational resources for traders in form of webinars, articles, and video tutorials along with 24/7 live chat support for traders.

#4 XM – MetaTrader Broker App

XM is one of the online Forex brokers offering standard MT4 & MT5 based apps for all devices (web, android, and iOS). You can trade 55 forex pairs and CFDs on 31 cryptocurrencies, 1,261 stocks, 8 commodities, 24 indices, 4 metals, 5 energies and 100 shares.

Safety – XM is licensed by the UK FCA and International Financial Services Commission (IFSC), Belize. Nigerian traders are registered under their regulation in Belize.

Fees – They have low spreads with Ultra-Low Account, starting at 0.6 pips. Major currency pairs like EUR/USD has an average spread of 1.6 pips with Micro Account. Their overall spreads are relatively high. XM Also charges commissions with the Shares Account. The broker has high Swap Fees for most instruments

XM does not charge deposit and withdrawal fees, and no commissions for opening positions or closing them. However, if your account is dormant for 90 days, it starts to attract monthly charge of $5.

Account – XM has 4 trading account types and an Islamic account with zero swaps. To start trading, a minimum deposit of $5 is required for the standard and micro-accounts, while Ultra Low and Zero accounts need to deposit $50 and $100 respectively.

XM has negative balance protection that prevents you from losing more money than you have in your XM account.

Trading Application – Trading applications supported by XM are the MetaTrader 4 and MetaTrader 5 accessible on the web, desktop and mobile devices (iOS and Android). XM also has their own mobile App for trading asides from MetaTrader.

Deposits & Withdrawals – Traders can make direct wire transfers to their trading accounts and have them credited within a few days. Cards and e-wallets (like Skrill, and Webmoney) deposits are credited instantly or within a few hours. XM has no limits on maximum deposits although the general minimum deposit is $5.

Withdrawals can be made via wire transfers to bank accounts and received within a few days or to cards and e-wallets and received within a few minutes. This also requires a minimum of $5.

The company currently does not support transfers to local banks in Nigeria, and they don’t have Naira trading accounts.

Support – XM offers good support. The education and research section of the website is very informative and helpful for new traders to learn from forex webinars, trade ideas, economic calendars and tutorials among others.

They have email, live chat, and international phone number support. You can reach them 24 hours Mondays through Fridays.

XM currently offer promotional bonuses of 50% deposits up to $500 and 20% up to $5000. They also give FREE Virtual Private Servers (VPS) to traders who have deposited up to $5,000 in their accounts.

User reviews suggest that the interface is a bit complicated and takes time to figure out.

#5 AvaTradeGo App – Good Forex Trading App for Fixed Spread

AvaTrade is an online trading platform that offers trades for 55 currency pairs, 18 commodities (energies, metals, oil), 44 FX options, 32 indices, 612 stocks, and 20 cryptocurrency pairs.

Safety – AvaTrade is licensed by Tier 1 & Tier 2 regulators like ASIC, FSCA, and Japan FSA. So they are considered low-risk and have a high trust score.

Traders from Nigeria are registered under Ava Trade Markets Ltd which is registered under BVI Financial Services Commission.

Fees – CFD Trading at AvaTrade is commission-free, and there are no deposit or withdrawal fees. AvaTrade spreads are fixed and competitive. The benchmark spread is 0.9 pips for pairs like EUR/USD. Their Swap fees are not the lowest though.

Account Features – AvaTrade has only one account type and you can start trading with a minimum deposit of $100. AvaTrade offers a 20% bonus for new clients depositing over $1,000. Deposits with cards are credited instantly. They also have negative balance protection. While the broker offers free deposits and withdrawals, inactive accounts incur a cost of $50 after 3 months of inactivity.

Trading Application – AvaTrade Supports the MT4 and MT5 trading platforms as well their own proprietary AvaTrader for web trading and AvaTradeGo mobile app available on iOS and Android. AvaSocial is another mobile trading application by AvaTrade that supports trade copying by allowing new traders to chat with expert traders and benefit from their expertise by copying their trades.

AvaTradeGo app features a user-friendly design, offering trading tools to newbies and experienced traders alike. Regular news updates, useful e-books, video tutorials, indicators and educational materials available on the platform are useful to those who are just diving into the world of online forex trading.

Deposit & Withdrawals – AvaTrade’s minimum deposit is $100 or €100 if EUR is your base account currency for all payment methods. Deposits are credited to your trading account within 24 hours for E-wallets, instantly for Credit/Debit cards, and up to 10 business days for Wire Transfer.

On AvaTrade, there is a minimum withdrawal amount of $100 for wire transfers and $1 for cards and e-wallets. It takes up to 5 business days for you to receive the funds withdrawn to your credit/debit card, 24 hours for e-wallets, and up to 10 business days for a wire transfer.

AvaTrade currently does not support online bank transfers via local bank accounts in Nigeria.

Support – Their chat, phone & email support is only available during the company’s European business hours. They have a Nigerian phone number For support. They have Frequently Asked Questions on their website to answer many questions traders may have.

#6 FXTM Trader App – Well Regulated Forex Trading App

FXTM Trader is a provider of financial trading services, offering over 2,500 trade instruments, including CFDs for 3 commodities, 1,288 shares, 829 CFDs stocks, 5 stock baskets, 5 metals, 17 indices, 6 FX indices, and 60 currency pairs.

Safety – The company is registered as ForexTime Limited in Cyprus and is well-regulated by CySEC, FCA, and FSCA. Which makes the broker score high on trust and is considered safe. Traders from Nigeria are registered under their license in Mauritius as Exinity Limited.

Fees – Deposits are free of charge and the average spread fee is around 2.1 pips for major currency pairs on Micro accounts, which is relatively higher than most brokers. Advantage account holders are charged spreads from 0 pips plus a $0.40 to $2 commission per lot side opened on trades with Majors. Naira accounts can also be maintained on the platform. While deposits are free, some withdrawal methods on FXTM attract a fee of $3 per transaction, and the broker charges $5 per month if your account becomes inactive for 6 months.

FXTM provides loyalty cashback bonuses to their traders from time to time. These loyalty bonuses can be withdrawn to your bank account if you reach the target amount.

Account Features – FXTM offers 3 trading accounts as well as an Islamic Account option for Muslim traders. Different FXTM account types determine the kinds of instruments you can trade. The broker also offers negative balance protection on all account types.

Trading Application – FXTM supports MT4, MT5, and FXTM Trader which is owned by FXTM. The broker has multi-platform support, meaning you can trade on the web or use their mobile apps available on iOS and Android devices.

Deposit & Withdrawals – FXTM supports Nigerian traders to deposit and withdraw funds via their bank accounts in Nigeria. The broker also supports cards and e-wallet payment methods. The minimum deposit on FXTM is ₦10,000 or $5, and deposits are credited instantly or within a few minutes.

All withdrawal requests are processed within 24 hours or 1 business day and require a minimum amount of $1 or ₦1,000.

Support – FXTM also offers a range of educational resources on their website, and 24/5 customer support via live chat, email, and Nigerian phone numbers. This includes personal account managers, who can assist and support you in your trading journey.

How We Selected the Best Forex Trading Apps?

You might have tried one or two forex trading apps. But you should know that choosing a reliable Forex trading app is very important to your success as a Forex trader.

This brings us to our methodology, traders in Nigeria should choose the Forex App of a broker that is regulated by Top-tier Regulators like FCA (Financial Conduct Authority) UK, FSCA (Financial Sector Conduct Authority) South Africa, and ASIC (Australian Securities and Investments Commission); should have local funding & withdrawals via Bank Transfer in Naira, good ratings & trading capabilities.

We have identified 5 key factors that make forex brokers stand out from the crowd below:

1. Trust Factor of the Broker

The level of trust accorded to a forex broker is determined by the category of regulators that have licensed the broker.

If a broker is regulated by multiple trusted authorities, it is a good sign. And if the broker is publicly listed or is a banking institution, that makes it even better.

You can verify a broker’s regulation.

For example, you can verify that HF Markets is licensed by FCA by searching their name or license number on the FCA website, through FCA’s public search at https://register.fca.org.uk/s/.

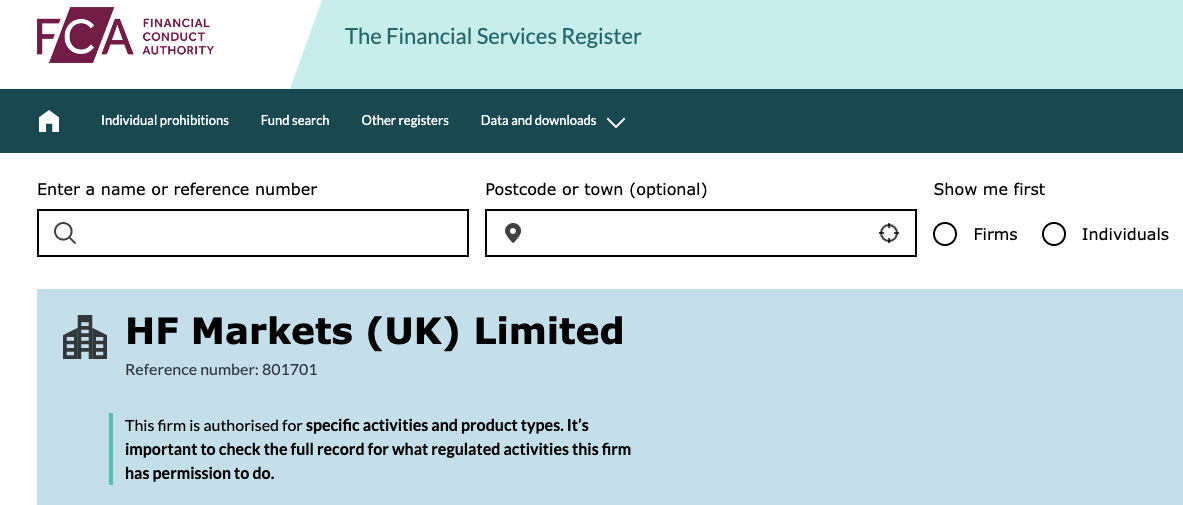

“HF Markets (UK) Limited” is Authorised by FCA since 14/11/2018 under Reference number 801701. Refer to the below screenshot.

Traders based in Nigeria are not registered under FCA at HF Markets and are registered under “HF Markets (SV)“, which is an Offshore Regulation. But HF Markets Broker is regulated under multiple Top-tier regulations, which is a good sign of trust.

The regulators and license numbers of brokers can be found on the ‘regulation page’ of their website.

2. Fees Associated with Trading App

The next factor for picking a broker is their trading and non-trading costs.

Most brokers currently charge zero fees for withdrawals, deposits, and, while being competitive with the spread and swap rates.

For example, in a EUR/USD pair trade. Say the bid price is 1.1300 & the spread is 1.5 pips. This means that the trader would pay $1.5 for a 1 Mini Lot trade. If you hold the position overnight, then there will also be Holding charges i.e. Swap Fees.

Ensure there are no hidden fees, commission costs are affordable, and the spread is not too wide, before using a brokerage app.

3. CFD Trading Instruments Available

Some brokers offer a large number of trading instruments, and some have a limited range.

For example, if you want to trade CFD for Oil, is it available? And what is the cost for the instrument in comparison to other brokers?

You should choose a trading broker that offers a plethora of trading instruments, allowing you to trade currencies, stocks, and commodities.

Please note that not every broker offers CFDs for every instrument, thus it is advisable to check which of your chosen instruments are available in CFD options before making your choice.

4. Is the App Easy to Use?

If you wish to start trading on your mobile phone, you must check that the app is available on your phone platform: i.e. Web-based, Android, or iOS.

The next step is to download it and try using it, then see how long it takes to register and perform some micro-tasks on it. Alternatively, you can read the feedback of other users to help you decide.

When choosing a trading app, you want to find something that’s not only open, free, and powerful but also simple to use.

5. Funding & Withdrawal Methods & Time

A crucial factor for selecting the best forex trading apps in Nigeria is how locally friendly is the app.

Do they accept deposits in Naira with NGN cards? And do they allow withdrawals to Nigerian bank accounts directly?

For example, HF Markets and Exness support deposits in NGN and withdrawals to local bank accounts. The transactions are processed relatively quickly (within a few days), and make trading easier.

The best forex trading apps in Nigeria are country-specific ones that support deposits in Naira, withdrawals to Nigerian bank accounts directly, have NGN as account currency, and process transactions quickly.

6. Other Features to Check on Trading App

There are a few other features that you should check in the app.

a. Risk management Tools: In unique situations, the market might execute your stop-loss order at an unfavourable price, leading to more losses. A guaranteed stop-loss order (GSLO) makes sure your stop-loss order is executed at your desired price. You should speak to your broker to know if they offer GSLO.

b. Is Customer Support Good or Bad: Your broker should be reachable via different means. Email, local mobile numbers, live chats, and instant messaging should be available. Quick response is the hallmark of good customer support so make sure to conduct a personal test.

c. Two Factor Auth: Does the platform support 2FA? This will provide added protection against hacking. Some forex brokers have 2FA for their accounts, and you should check this with the support of the broker that you intend to signup with.

d. Education: You want to choose a forex broker that allows you to learn. This is why education on trading apps should be key for you. The education content could be videos, written content, podcasts, or ebooks. Most of the content is usually on the broker’s websites.

Is forex trading halal?

While it is haram to pay riba on trades, Some forex brokers offer swap-free accounts that are compliant with Islamic principles of no riba, these brokers offer accounts that eliminate overnight interest charges. Some brokers in Nigeria with Islamic accounts are Octa, HF Markets, XM and AvaTrade among others.

Highest leverage forex broker

Leverage in forex trading amplifies your potential profits and losses. While it can magnify your gains, it can also lead to significant losses if the market moves against you.

In Nigeria, forex trading is not regulated, so online forex brokers have no maximum leverage that they must adhere to. Most forex brokers offer high leverage from 1:400 to 1:2,000 and some even offer 1:unlimited.

Some high-leverage forex brokers in Nigeria that offer high leverage are HF Markets – 1:2,000, FXTM – 2,000, and XM Trading – 1,000. With a forex leverage of 1:1,000, this means that if you deposit NGN10,000, you can control up to NGN10,000,000 worth of trade value.

Low spread forex brokers

Spread in forex trading is the difference between the bid price and the ask price of a currency pair.

The bid price is the price at which you can sell a currency. Ask price is the price at which you can buy a currency.

For example, if you want to buy euros (EUR) using US dollars (USD). Your forex broker may quote you the following prices for the EUR/USD currency pair:

-Bid price: 1.1050

-Ask price: 1.1052

The spread in this case is 2 pips, which is the difference between the bid price and the ask price.

The spread is essentially the broker’s fee for facilitating your trade. While it is a revenue source for forex brokers, it is a charge to you, the trading. To reduce your trading costs, it is best to trade with a broker that charges low spreads.

Choosing the right low-spread forex broker depends on various factors, including your trading style, budget, and desired features. Here’s a breakdown to help you navigate the options:

Top Low-Spread Forex Brokers in Nigeria:

1) Tickmill: Offers tight spreads starting from 0.1 pips with commission-based accounts and raw spreads from 0.9 pips.

2) AvaTrade: Known for its consistently low spreads averaging around 0.9 pips on major pairs like EURUSD.

3) Octa: Provides tight spreads (as low as 0.9 pips on EUR/USD) and commission-free trading on all instruments.

Are Forex Trading Apps legal in Nigeria

There are not completely legal forex apps in Nigeria. This is because all the apps are by foreign CFD brokers who don’t have license in Nigeria. These apps operate from outside the country, but still onboard clients under offshore jurisdictions.

To take an example, Exness onboards Nigerian traders on to their foreign entity ‘Exness (SC) Ltd’, which we have covered in our review. This entity is based in Seychelles.

Exness does not have any local entity licensed in Nigeria. Nor does any other forex broker. All these brokers still promote their apps to Nigerian traders. You must be aware of this counter-party risk when trading with any forex apps.

If there is no local regulation in your country, the risk for any individual trader is higher.

How Do Forex Trading Apps Make Money?

Trading apps do not generate money independent of forex brokers. Most of the fees you will pay will go to your broker. It does not matter if the app is proprietary or from a third-party.

Brokers make money from trading apps in multiple ways. However, we can simplify all of them into trading and non-trading fees. Trading fees are the money you pay to your broker for every trade you make. It does not matter if you won the trade or lost. You will pay these fees.

Spreads, commissions, and swaps are the main trading fees charged by brokers on trading apps. Spread is the difference between the buy and sell price of the CFDs you are trading. Swap is the fee you pay for holding your trades overnight while commissions are usually charged where spread is low.

If you are trading on MT4/MT5 on your mobile device, you will see the amount commission and swap you are charged per trade. Non-trading fees are not connected to trading. They include account inactivity fees (if you don’t place a trade for a certain period), currency conversion fees, etc.

Finally, not all brokers have the same fee structure for their trading apps. A broker may have a low spread account on MetaTrader or offer a commission-free package on their proprietary trading app. Furthermore, inactivity fee is not the same too. Some brokers charge it, some don’t.

So make sure you research your broker’s fee structure before signing up on their trading app.

Is there a difference between forex trading apps and software?

Anything application has to do with mobile phones or tablets. So it is not difficult to understand what forex trading apps are. They are designed and tailored for mobile phones so you can have a smooth experience when trading.

Forex trading software are quite different. They are designed for your laptops, PCs, and desktops. A major advantage software have over apps is the clear view you get. You can see price movements are use charting tools more conveniently with forex trading software.

In addition, you have a better user experience with the advanced trading tools on the software. Tools like backtesting and automated trading are easier to use on trading software because of the view. In summary, forex trading apps are built for convenience and are user friendly. You can be on the move and monitor your trades.

For trading software, you need to be settled with a work station or an office space even especially if you are a full time trader. You cannot carry desktops about. Though some laptops are light enough to carry, they are not as easy to use on the go like trading apps.

So which is better for you? The answer depends on you, your preference, and how you want to trade.

Trading features to look for when choosing a forex trading app

Here are some of the trading features you should check for in your mobile trading app:

1) Watchlists: Watchlists allow you to customize your favorite CFDs into a list so you can track them easily. There is a lot of CFDs in the market. Being able to narrow your focus on a few of them might be helpful.

2) 1-click trading: You don’t always have to use the popup feature when placing your order. 1-click trading allows you to place your order faster. However, some trading apps have terms and conditions connected to using this feature.

Ensure you read and understand this conditions before agreeing to use 1-click trading.

Is there an official trading app for Forex

Forex trading does not have an official trading app. This is because the market has no central physical location. It is a decentralized market. Central banks, financial institutions, forex brokers, and large corporations make up the forex market.

Trading apps for forex are supplied by forex brokers. The app could be own by the broker or developed by a third-party company like MetaQuotes (MetaTrader 4 and MetaTrader 5).

What are the risks of using forex trading apps?

Forex trading apps make on-the-go trading easy, but they also expose you to price volatility. The forex market is unpredictable, with prices changing quickly due to fundamental factors like news, geopolitical issues and economic releases. Traders using mobile apps need to be ready for sudden price changes that can hugely affect your loss or profit because of leverage.

In addition, unregulated mobile apps constitute a huge risk to you. This lack of regulatory oversight might allow forex brokers engage in unethical business practices such as price manipulation, stop hunting, or even denying withdrawal requests. It’s crucial for traders to do thorough research and sign up with mobile apps that are regulated with top-tier regulators like the UK’s Financial Conduct Authority. Doing this will also protect you from clone firms.

Cybersecurity threats are also a source of major concern. Trading through mobile apps can expose you to hacking and malware risks. Unauthorized access to your account can result in stolen funds or worse. To mitigate these risks, make sure your password is strong, enable 2FA, and avoid logging into your trading accounts over insecure connections like public Wi-Fi.

FAQs on Best Forex Trading Apps in Nigeria

Which Forex Trading App is the Best in Nigeria?

HF Markets App is considered the best Forex trading app in Nigeria because it is available on both iOS and Android, has an NGN account currency, supports local bank transfer in Nigeria and has a low minimum deposit. The HF Markets app also allows trade copying.

Also, HF Markets is a well-regulated forex broker which makes trading with them low risk.

Which Forex App has lowest Fees?

Octa is the forex broker with the lowest trading fees. They do not charge any deposit or withdrawal fees, offer commission-free and swap-free trading on all accounts, charge no dormant account fees and have moderate spreads. Their typical spread for majors like EUR/USD is 0.9 pips with both their MT4 & MT5 account types.

How much do you need to start trading forex in Nigeria?

You can start trading with as little as 4,000 NGN with HF Markets or 5 USD. Some brokers may charge as high as 15,000 nairas for Octa and up to 100 USD with AvaTrade.

Which app is best for forex trading for beginners?

The best app for trading forex for beginners in Nigeria is the HF Markets App. The app is available on both Android and iOS devices. The app has NGN account currency, negative balance protection and a relatively low minimum deposit in Naira. The app is also safe because the broker is regulated by Top-Tier financial regulators.

Which brokers have their Apps available on Android?

The forex brokers that have their apps available on Android Google Play Store are HF Markets, FXTM, Exness, AvaTrade, XM and Octa.