| HF Markets Minimum Deposit Summary | |

|---|---|

| HF Markets Minimum Deposit | $0 (₦0) |

| Deposit Methods | Credit/Debit Card, Local Bank Transfer, e-Wallets |

| Account Types | Cent Account, Premium Account, Pro Account, Pro Plus Account, Zero Account, Top-Up Bonus Account |

| Deposit Fees | No Fees |

| Account Base Currencies | USD, GBP, EUR, NGN |

| Withdrawal Fees | No Fees |

| Visit HF Markets | |

HF Market’s minimum deposit in Naira is ₦0 ($0) for four of their six accounts in Nigeria.

When embarking on your forex trading journey, one of the first questions that naturally arises is, “How much money do I need to start?”

HF Markets (HFM) formerly called Hotforex, a forex and CFDs broker, offers a range of solutions to suit different budgets and trading styles.

Let’s explore the minimum deposit requirements of HF Markets, payment methods, step-by-step guide to deposit and more, in this review.

What is the minimum deposit for HFM Nigeria

The minimum deposit on HFM is ₦4,000 via local bank transfer, other payment methods have different minimum deposit. That’s an accessible amount for almost anyone looking to test the forex trading waters.

However, HF Markets have different account types that require different minimum deposit amounts to activate the account and start trading. Here is a summary:

1) Premium Account: Tailored for retail clients, the HF Markets Premium Account doesn’t enforce a mandatory minimum deposit. You can deposit any amount you prefer.

2) Pro Account: Designed for experienced retail traders, the HF Markets Pro Account requires a minimum deposit of ₦50,000.

3) Pro Plus Account: Geared towards experienced retail traders, the HF Markets Pro Plus Account mandates a minimum deposit of ₦200,000.

4) Zero Account: Ideal for retail clients engaging in high-volume trading, utilizing EAs, and seeking lower spreads, the HF Markets Zero Account doesn’t demand a mandatory minimum deposit.

5) Cent Account: Specifically crafted for new traders, the HF Markets Cent Account allows trading in forex and gold exclusively. There’s no mandatory minimum deposit, and the account balance is denoted in Cents (United States Cents), where $10 is represented as 1,000 cents.

6) Top-up Bonus Account: Designed for retail clients, the HF Markets Top-up Bonus Account doesn’t impose a mandatory minimum deposit.

Read more on HFM’s account in our HF Markets review.

Accepted Deposit Methods on HFM Nigeria

HF Markets offers a number of options for depositing funds. Here’s what you can use:

1) Credit/Debit Cards: The classic choice, Visa and MasterCard are widely accepted on HF Markets. The minimum deposit via this method is $5 (₦8,000) Deposits via cards on HFM are credited within 10 minutes.

Minimum withdrawal via cards on HFM is $5 (₦8,000). It takes about 24 hours for you to receive the funds after initiating a withdrawal.

2) Bank Wire Transfers: Good for larger deposits, you can make deposits to your HFM Account through your local bank in Nigeria using Naira (NGN). Bank transfer deposits are credited instantly.

The minimum deposit for bank transfer deposit on HFM in Nigeria is ₦4,000.

The minimum withdrawal via bank transfer is $10 (₦16,000) and it takes 24 hours for funds to reach your account.

3) E-wallets: Popular options like Skrill and Neteller are supported for deposits on HF Markets. E-wallet deposits are credited within 10 minutes to your trading account. The minimum deposit amount for e-wallets on HF Markets is $5 (₦8,000).

Minimum withdrawal with e-wallets on HFM is also $5 (₦8,000) and it takes only 10 minutes for you to receive the funds or it happens instantly.

Note: CFD trading is risky

HF Markets Deposit Methods Table

Here is a summary of payment methods accepted by HF Markets for deposits.

| Deposit Methods | Availability | Minimum Deposit | Charges | Processing time |

|---|---|---|---|---|

| Internet banking/bank transfers | Yes (NGN) | ₦4,000 | Free | Instant |

| Cards | Yes | $5 (₦4,000) | Free | 10 minutes |

| E-wallet | Yes (Skrill & Neteller) | $5 (₦8,000) | Free | 10 minutes |

HF Markets Deposit Rules

1. Deposit Fees: HF Markets does not charge any deposit or withdrawal fees. Nonetheless, the third-party payment processing platform you use, such as your bank or card, may impose independent transaction fees.

2. Deposit Time: You can initiate deposits and withdrawals from your trading account at any time, on any day. However, in cases where instant processing is not feasible, you may experience a wait time of up to 24 hours for deposits and up to a few days for withdrawals.

3. Payment Source: HF Markets only accepts deposits from payment methods (bank account and cards) that are in the same name as the name used on your HFM trading account.

Withdrawals are also only made to same sources you have used to make deposits and must bear your name as well. HFM does not process payments from or to a third party account.

How do I deposit my HFM account?

Step 1) Begin by logging into your dashboard either through the HF Markets website or via my.hfm.com/sv/login.

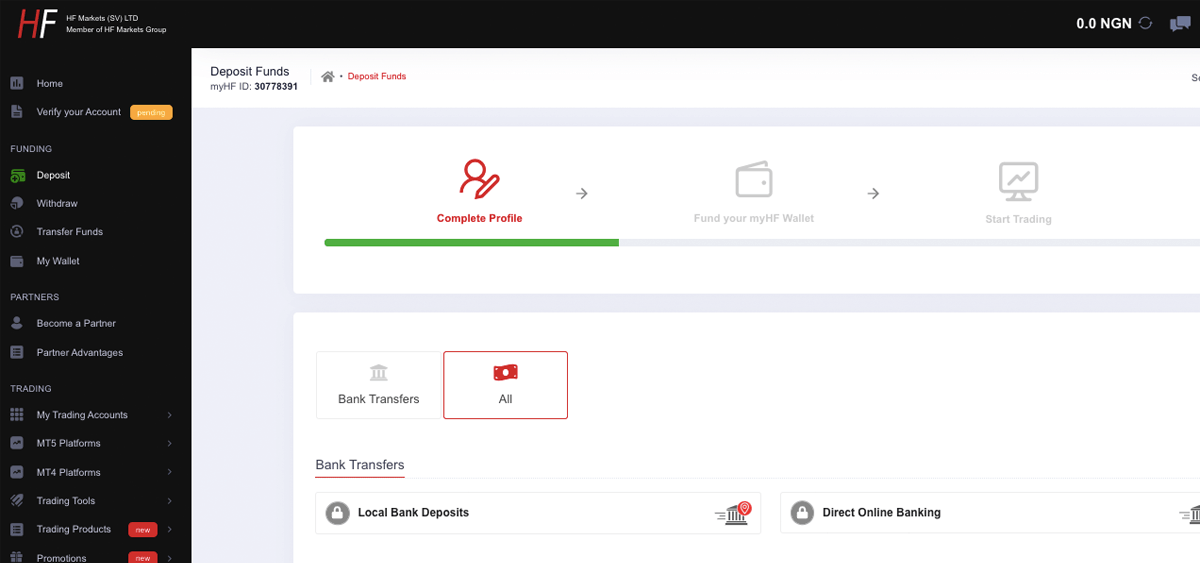

Step 2) Once logged in, navigate to the left column menu on the desktop view and select ‘Deposit’. From there, choose either Local Bank Deposit or Direct Online Banking to proceed with deposits in Naira.

You’ll be presented with Nigerian bank accounts linked to HF Markets for your payment transactions.

Step 3) Complete the deposit process by transferring funds to any of the provided accounts, ensuring to use your ‘myHFID:’ as the transaction description.

Upon successful deposit, the funds will be credited to your myWallet, which you can then transfer to a trading account on your dashboard to initiate trading.

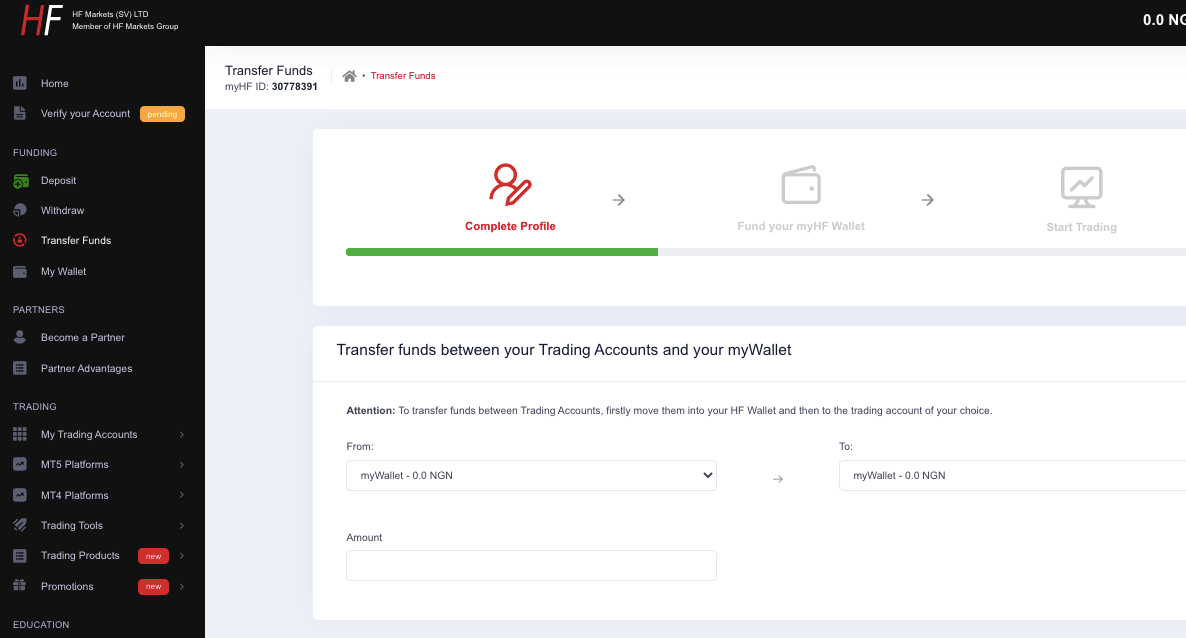

Step 4) To transfer funds between accounts, find ‘Transfer Funds’ on the left side menu of your dashboard. Click on it and proceed to transfer funds from your myWallet to a live trading account or vice versa.

Simply input the desired amount for transfer, click ‘start transfer’, and follow the on-screen prompts to finalize the transfer.

Note: Please keep in mind that HF Markets only approves deposits from accounts or payment methods that bear the same name as your HF Markets trading account.

Comparison Of HF Markets Minimum Deposit With Other Brokers

Here is a comparison of HF Markets minimum deposit with that of their competitors.

| Broker | Minimum Deposit |

|---|---|

| HF Markets | ₦0 ($0) |

| Exness | ₦16,000 ($10) |

| OctaFX | ₦30,000 |

| FXTM | $200 (₦320,000) |

| AvaTrade | $100 (₦160,000) |

| XM | $5 (₦8,000) |

Note: CFD trading is risky

What base currencies are accepted by HFM?

HFM supports different funding methods. They accept different currencies for deposits based on traders’ regions. Some of the currencies accepted are GBP, EUR, ZAR, NGN, KES, MYR, KHR, IDR, KES, UGX, TZS, etc.

HFM Nigeria Minimum Deposit FAQs

What is the minimum deposit for HFM zero account?

$0. The Zero Account on HF Markets requires no mandatory minimum deposit. You can activate the account without any deposit, however to start trading, you must make a deposit, and the minimum deposit you can make via the payments method is ₦4,000 or $5.

How long does HFM deposit take?

Credit/debit card payments and e-wallets are usually instant or within 10 minutes. Local bank transfers in naira are deposited instantly while international bank wire transfers may take a few business days to reflect on your account. The processing time for your deposits to show in your account depends on your chosen deposit method.

How much does it cost to start trading on HFM?

HF Markets has accounts with no mandatory minimum deposits, but to start trading on HF Markets platform, you will need to deposit a minimum of NGN 4,000 or $5. HFM does not charge any deposit fees, but you will pay spread on the trades you initiate.

What is the minimum deposit for HFM in Nigeria?

The minimum deposit on HF Markets is ₦4,000 via local bank transfers. The minimum deposit is $5 with cards or e-wallets. These minimum deposits is different from that of the trading accounts.

Does HF Markets Charge for Deposits?

HF Markets generally doesn’t charge deposit fees. That means any time you top up your trading account, the entire amount arrives intact.

Does HFM give no deposit bonus?

HFM offers 20% deposit bonus on all transfers to your trading account. This bonus is capped at a maximum of ₦7 million naira. This is called ‘Top-up bonus’, it is available to all clients and while you cannot withdraw the bonus, any profits realised from using it to trade can be withdrawn.

Note: Your capital is at risk