| IC Markets Minimum Deposit Summary | |

|---|---|

| IC Markets Minimum Deposit | $200 (₦320,000) |

| Deposit Methods | e-wallets, Wire Transfer, Broker-to-Broker |

| Account Types | MT4/MT5 Raw Spread Account, cTrader Raw Spread Account, Standard Account |

| Deposit Fees | No fees |

| Account Base Currencies | USD |

| Withdrawal Fees | No fees |

| Visit IC Markets | |

IC Markets minimum deposit in Nigerian Naira is ₦320,000 ($200).

IC Markets is a forex broker that provides financial services to traders in Nigeria. They are licensed with Financial Services Authority (FSA) based in Seychelles and offer varying trading accounts to meet their clients’ need.

In Nigeria, IC Markets has a single minimum deposit. Though their accounts have different trading conditions, one thing is common with all of them. It is the minimum deposit.

We have expertly researched all the four live accounts. you can open with IC Markets if you are resident in Nigeria.

Let us show you what we found.

How Much is IC Markets’ Minimum Deposit in Nigeria?

Now, we go into IC Markets’ trading account in brief details.

1) cTrader Raw Spread Account

The cTrader Raw Spread Account is an electronic communication network (ECN) account. You will need $200 (₦320,000) minimum deposit to open this account.

Because it is an ECN Account, the spreads are razor sharp and begin from 0.0 pips. Typical with most ECN trading account, there will always be a commission.

Per standard lot, your commission for trading on this account is $3.0 ($6.0 per lot roundturn). This account allows all trading styles but it is most suitable for day traders and scalpers.

Finally, you can have this account on cTrader and TradingView only.

2) MT4/MT5 Raw Spread Account

This is the MetaTrader version of the cTrader Raw Spread Account. It is also an ECN account and you will need $200 (₦320,000) minimum deposit to have one.

The pricing of the spreads is raw beginning at 0.0 pips. The spreads are institutional grade and executable streaming prices. They come from IC markets’ liquidity providers and are sent to to you without a dealing desk or manipulation.

You will pay a commission of $3.5 ($7 roundturn) per every standard lot traded. If you trade with EA, or you are a scalper, this account is suitable for you. You can have it on MT4 and MT5 only.

3) Standard Account

IC Markets’ Standard Account is available on MT4 and MT5. It is a zero commission account and the spreads are not razor sharp. Your minimum deposit for this account is also $200 (₦320,000).

Spreads begin from 0.8 pips and you have access to an extensive network of up to 25 liquidity providers. This account is suitable for all trading styles.

However, it is more suitable for traders who are more discretionary.

4) Islamic Account

This account complies with the Shariah Law. If you cannot pay or earn interest because of your religious beliefs, this is the account for you.

The account is swap-free which means you will not receive or pay overnight charges. However, there is an holding fee for positions held overnight. You can open the Islamic as a Standard Account or Raw Spread Account on cTrader, MT4, and MT5.

Minimum deposit for IC Market’s Islamic Account is $200 (₦320,000). IC Markets may require some documents in order to offer you their swap-free account.

Note: CFD trading is risky

5) IC Markets Demo Account

IC also offers a Demo Account. This account is available across all of their trading platforms. You can practice with the Raw Spread Account or Standard Account.

A demo account helps you learn about the trading conditions of your account without risk.

IC Markets Deposit Methods and Required Fees

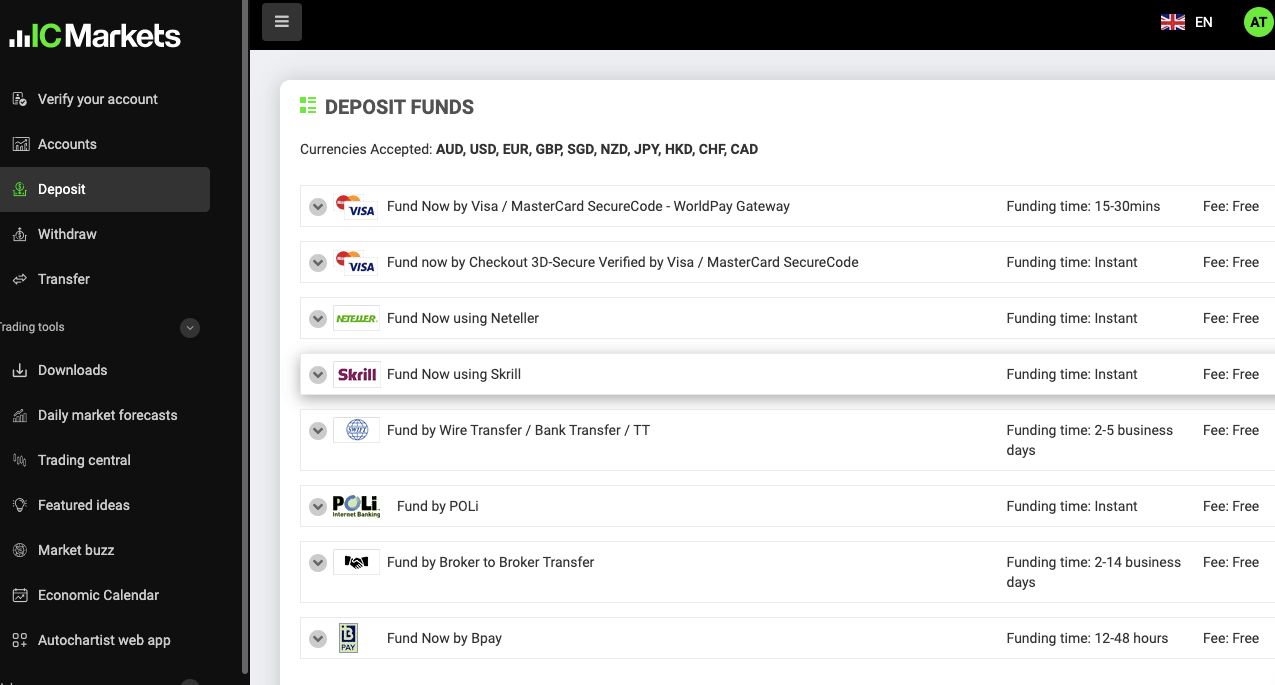

When we reviewed IC Markets, we found that they offer seven (5) payment methods that allow you fund your account in USD. None of the payment methods support deposits in Nigerian Naira (NGN).

Here is a brief breakdown of these methods.

1) Credit/Debit Cards: IC Markets accept debit/credit cards from Visa and MasterCard only. Funding is instant without extra charges.

2) Neteller: Deposit is instant and free of charge.

3) Skrill: IC Markets offer Skrill as a funding method too. Your money reflects in your account instantly.

4) Wire Transfer: Bank wire transfer is also supported by IC Markets. It may take 2-5 business days to complete the transaction.

5) Broker-to-Broker: You can transfer funds from another broker too. Your money should get to your account in 2-5 business days.

Note: Your bank or payment service providers may charge you a commission. IC Markets does not charge any fees for deposits. In addition, you will find PayPal as one of the deposit options on IC Markets Global website. However, you should know that PayPal no longer offer services to Nigerian residents.

IC Markets Deposit Rules

1) It is best to fund your account via your client secure client area. Your payment is processed speedily and your money gets to your account quickly and securely.

2) IC Markets will not process payments from third parties. Make sure all payments into your trading account come from a bank in your name.

3) Payments from joint bank accounts or credit card are accepted if you are one of the parties on the bank account or credit card.

How to Deposit Funds Into Your IC Markets’ Account

1) Log in to your secure client area through https://secure.icmarkets.com/Account/LogOn?ReturnUrl=%2f. Enter your email address and password.

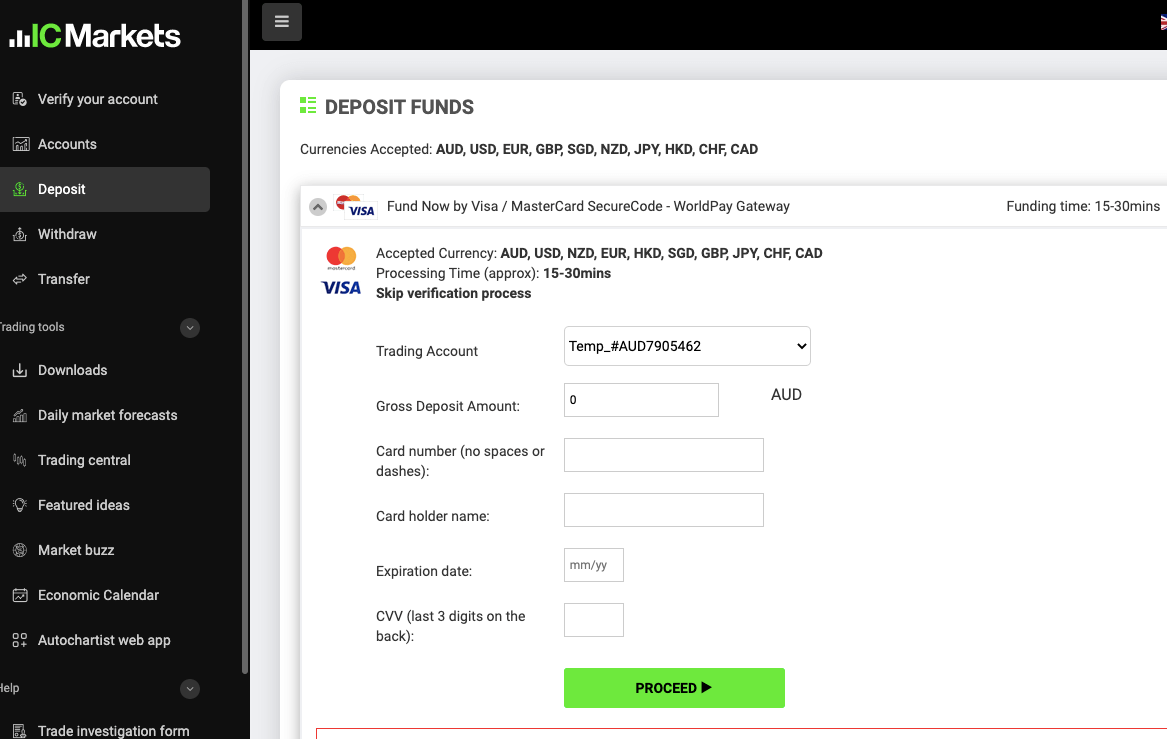

2) On the left side menu, click ‘Deposit’. You will see different deposit methods. Choose the method and base currency you prefer for the transaction.

3) Enter the minimum deposit required for your account and other needed information. Then click ‘PROCEED’.

Comparison Of IC Markets Minimum Deposit With Other Brokers

Here is how IC Markets minimum deposit compare to other brokers in Nigeria.

| Broker | Minimum Deposit |

|---|---|

| IC Markets | $200 (₦320,000) |

| HF Markets | $0 (₦0) |

| Exness | $100 (₦160,000) |

| Plus500 | $100 (₦160,000) |

| Tickmill | $100 (₦160,000) |

| Octa | ₦30,000 |

Note: CFD trading is risky

What base currencies are accepted by IC Markets?

The base currencies accepted by IC Markets are AUD, USD, EUR, GBP, CHF, NZD, JPY, SGD, CAD, and HKD

Frequently Asked Questions

Does IC Markets have a minimum deposit?

Yes, IC Markets have a minimum deposit for all of their trading accounts.

What is the minimum funding for IC Markets?

The minimum funding for IC Markets is $200 or currency equivalent. This deposit is the same for the Raw Spread , Standard, and Islamic Accounts.

What is IC Markets minimum deposit in Nigeria?

IC markets minimum deposit in Nigeria is ₦320,000 ($200).

What is the minimum withdrawal from IC Markets?

IC Markets does not have a minimum withdrawal limit. There is also no limit to how often you can withdraw funds. Only bank transfers have a minimum withdrawal of $50 (₦80,000) or currency equivalent.

Is my money safe with IC Markets?

IC Markets have different structures to keep your money safe. First, Electronic payments are processed using SSL (Secure Socket Layer) technology which secures your transaction. In addition, they keep your money in a segregated client trust accounts with top-tier international banks.

Note: Your capital is at risk