| Tickmill Minimum Deposit Summary | |

|---|---|

| Tickmill Minimum Deposit | $100 (₦160, 000) |

| Deposit Methods | Bank transfer, SticPay, Webmoney, Skrill, Crypto Payments |

| Account Types | Pro Account, Classic Account, VIP Account |

| Deposit Fees | No fees |

| Account Base Currencies | USD, GBP, EUR |

| Withdrawal Fees | No fees |

| Visit Tickmill | |

Tickmill’s minimum deposit in Naira is ₦160,000 ($100). This applies to only two of their accounts. There are Tickmill trading accounts with much higher minimum deposits for CFD trading

You can choose from a pool of four live accounts if you sign up with Tickmill. Our team of editors have researched all of these accounts with their minimum deposits for you. In this article, we share what we have found

How Much is Tickmill Minimum Deposit in Nigeria?

Tickmill’s minimum deposit depends on the account you choose. There are some accounts with stipulated minimum deposits. There are also accounts without one.

So let us look into these Tickmill accounts.

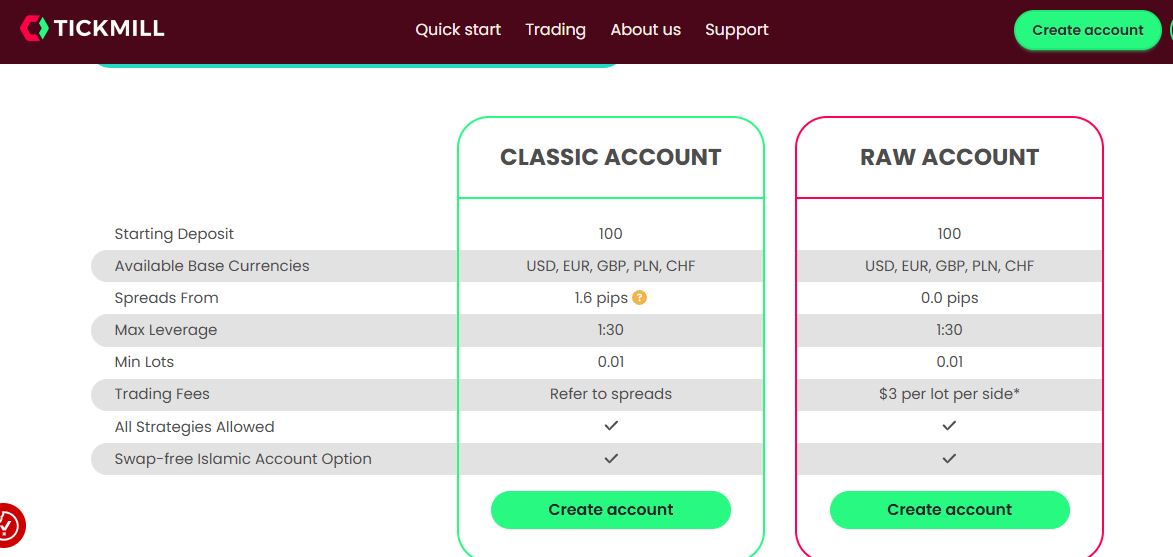

1) Classic Account

Tickmill’s minimum deposit for a Classic Account is £100 . The spread on this account is higher. They begin from 1.6 pips.

All trading strategies are allowed with 0.01 ad the minimum lot size. Trading fees refer to the spread alone. You do not have to pay any commission per standard lot on this account. That probably explains why the spreads are higher.

2) Raw Account

Tickmill’s minimum deposit for their Raw Account is £100.

This account is a low spread account with spreads beginning from 0.0 pips. You can trade all strategies on this account. Minimum lot size permitted for trading is 0.01. In terms of trading fees, you will pay a commission for every standard lot that you trade.

The fee is two $3 currency units per side per standard lot.

Tickmill Trading Accounts Overview

Note: CFD trading is risky

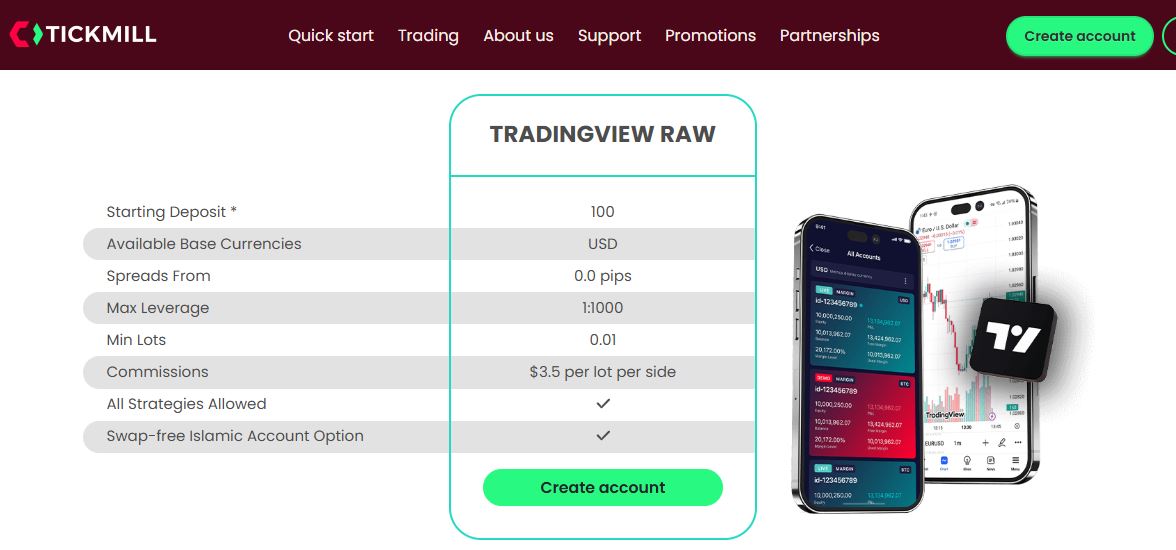

3) TradingView Raw Account

Minimum deposit for the TradingView Raw Account is $100. It is similar to the Raw Account. The difference is that the TradingView Raw Account has higher commissions.

4) Islamic Account

Tickmill’s Islamic Account is swap free and Shariah compliant. It is for Muslim traders who cannot pay or receive rollover charges because it is haram.

Tickmill’s swap-free account allows you to trade in halal way. As per our Tickmill review, you can open any of the regular accounts (Pro, Classic, and VIP) and then convert it to an Islamic Account.

This means the minimum deposits $100 (₦160,000) and trading conditions remain the same. The only difference is that there are no overnight charges on trading instruments.

Note: CFD trading is risky

Tickmill Deposit Methods and Required Fees

Tickmill has seven funding methods that lets you fund your account in USD. None of the methods allow funding in Nigerian Naira (NGN).

Now we breakdown these channels and their fees.

1) Bank transfer: Tickmill supports funding your account through a local bank transfer. Tickmill charges no fee but your bank will charge you per transaction. If you fund your account with more than $5000 ₦8,000,000), Tickmill will pays your bank charges.

Payment and processing may take up to 2-7 business days.

2) Credit/debit cards: Tickmill accepts cards for Visa and MasterCard. processing of payment is also instant. No extra fees from Tickmill.

3) Skrill: Fund your account with your Skrill e-wallet without extra charges. Your money should reflect in your account instantly for free.

4) Neteller: Neteller is also provided by Tickmill for account funding.

5) SticPay: SticPay is also supported by Tickmill for Nigerian traders.

6) Webmoney: Webmoney works in Nigeria and you can use it to fund your account.

7) Crypto Payments: You can fund your accounts with digital coins

Note: Though Tickmill charges no fees for deposits, these payment service providers might charge a fee of their own. These costs will be borne by you. All the methods above allow deposit in USD.

Tickmill Deposit Terms

1) Tickmill does not accept any payments made via a third-party source. Make sure your payments comes from cards, wallets, or bank accounts that bear your name.

2) Tickmill can require proof of identity from you if they so desire. Your payment can be frozen or refunded if you do not comply.

3) You may be charged a penalty processing fee if you make a third-party payment

4) All deposits starting from $5000 (₦8,000,000) or equivalent via a single bank wire transaction under Tickmill’s Zero Fees Policy. Tickmill will also cover transaction fees up to 100 USD or equivalent in another currency.

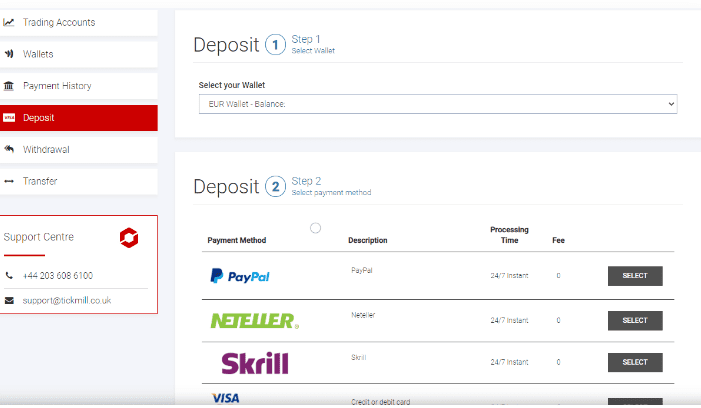

How to Deposit into Your Tickmill Account

1) Log in to your Tickmill personal area

2) Select Deposit on the left hand side. Choose your deposit method.

3) Enter the necessary details and complete your payment.

Comparison Of Tickmill Minimum Deposit With Other Brokers

| Broker | Minimum Deposit |

|---|---|

| Tickmill | $100 (₦160,000) |

| FXTM | $200 (₦320,000) |

| HF Markets | $0 (₦0) |

| Octa | ₦30,000 |

| AvaTrade | $100 (₦160,000) |

| IC Markets | $200 (₦320,000) |

Note: CFD trading is risky

What base currencies are accepted by Tickmill?

Tickmill allows the following currencies for deposits: GBP, USD, EUR, and ZAR. Ensure you only deposit in your account’s base currency to avoid currency conversion fees.

What is Tickmill minimum withdrawal?

For all withdrawal methods, the minimum withdrawal for Tickmill is $25 (₦40,000).

Note: Exchange rates from dollars to naira is accurate as at March 26,2025.

Frequently Asked Questions

Is Tickmill a trusted broker?

Tickmill is not locally regulated in Nigeria. However, they are regulated with tier-1 regulator like the FCA. Furthermore, Nigerian traders are registered under Tickmill\s Seychelles entity (FSA)

What is the minimum leverage in Tickmill?

The minimum leverage for Tickmill is 20:1 for retail clients. This leverage does not apply for all CFDs offered by Tickmill.

How do I deposit money into Tickmill?

You can deposit money to your Tickmill trading account by logging in to your client area. From there, you can choose your deposit method.

Does Tickmill accept PayPal?

Traders in Nigeria cannot fund their account through PayPal. Tickmill does not support PayPal in Nigeria. Also, PayPal no longer offer their services to residents in Nigeria.

How long does it take to withdraw from Tickmill?

It depends on channel you choose to withdraw your funds. The shortest time is within a working days. However, withdrawing though a bank can take up to 2-7 business days.

Does Tickmill have Islamic Account?

Yes, Tickmill has a swap-free, shariah compliant trading account.

Note: Your capital is at risk